Update 21 December 2022: MTD for ITSA delayed 2 years, will now start 5 April 2026, and applies to a way smaller base. Theses are the key changes:

Starting 6 April 2026 shall apply to roughly 740k users, people that need to register have a combined Self employment and property income of over £50k. From April 2027, the threshold drops from £50k to £30K and will increase the user base to roughly 1.6 millions people.

- There is no plan for Partnerships to fall under MTD for ITSA.

- It's all subject to change, and it's likely the threshold will also be applied to lower threshold self employed people.

- HMRC are looking at the API's, no road map but will put it together at some point. The Sandbox will be reviewed for API testing (let see what comes out).

- The new penalty points system only starts in 2026.

- MTDfCT does not have any dates i.e. the 2026 start has been scrapped and no new date set. HMRC plan to do MTDfCT at some point.

- There is no change to the Basis Period Reform (BPR).

Making

Tax Digital (MTD) for Income Tax Self Assessment (ITSA) is the replacement process to HMRC's Self Assessments (SA) that starts 6 April 2024 6 April 2025. Of the 12 million UK people registered for Self-Assessment, roughly 40% are mandated to switch over to MTDfITSA on the 6th of April 2024 (circa 4.2 million individuals). A combined gross income of over £10k from people with either a self employed business or a property business will need to register.

Are you or you self-employed client in?

Do you have over £10k income from self-employed businesses, then yes, from April 6 20224 you'll need to be using digital records to do quarterly submissions. You first MTD for ITSA submissions are due submission for the quarter 6 July 2024 and 5 Aug 2024.

What software options are the options?

There are approved vendors on HMRC's website for ITSA submissions, everyone has to submit via approved software vendors. Anecdotally, Free Agent, Sage, Xero and QuickBooks are going to offer Quarterly self assessments submissions tied to their bookkeeping products. Free agent is good for small customers, keep it simple. I also quiet like what I have seen from Sage for accountants coupled with bookkeeping. Personally, I've use QB for many years and played with Xero, both are excellent products and are strongly focuses on have MTDfITSA quarterly submissions.

There are software vendors that shall also look at bridging software solutions which will be more useful to self-employed businesses that support spreadsheets and are likely to be used by individuals to keep their costs down. Accounts are likely to look at TR, Sage for Accountants, Capium, BTC, and WK for full practice management tooling including MTDfITSA, these vendors providing full suite solutions are likely to offer bridging and retrieve from source (booking and open banking) options for holding the digitally linked data. Coconut looks interesting for individuals.

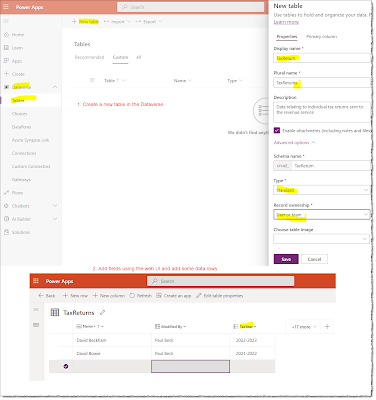

How do I enroll a client on MTDfITSA pilot?

Call HMRC and get client registered with HMRC for the pilot. Software can be used to assign client to their accountants software.

Is there a new penalty system coming in?

There is a new penalty and fining systems, the amounts of returns and work to complete an ITSA is significantly more than the single once a year SA.

Summary of comparison between ITSA & SA:

|

SA

|

ITSA

|

|

1 SA return done

each year per person.

|

4 quarterly

returns via approved software per business, required a digital record link to

the underlying transactions per self-employed business

1 End of

Period Statement (EOPS) per business.

Crystallization/Finalization

using HMRC approved software per person

|

|

Paper

submission due 31 Oct for previous year.

Online

submissions due 31 Jan – 9 months after financial/tax year end.

|

Approved

Digital Software to submit (no paper returns). 1 month after each quarter, submit the quarterly return, these can be revised later. Each EOPS is due on 31 Jan the following year. The Crystallisation/Finalisation/Final Declaration is also due 31 Jan the following year.

|

MTDfITSA has been pushed back twice (although it is in pilot) and it's scoped changed. ITSA follows on from

Making Tax Digital for VAT (MTDfV) that is already live.

HMRC use paper for self-assessments,

then allowed XML submissions, and is starting MTDfIT to enable individuals to

do their own Self-assessments. Many people doing Self Assessments will be

affected, and the associate costs & time shall be higher. Just under

40% of people file SA themselves. If they need to be on MTDfITSA, it is highly

likely that these smaller businesses will be severely impacted. I believe

Accountants that are doing small business self-assessment in the £400-£1,400

range will probably need to double or more these fees. It all comes down to will the client do the quarters and the account just does the final submission, in which case there should not be much of a cost change. Realistically, some clients will need booking to record the transactions and others will merely need guidance and year end adjustments from the accountant. SA submissions start at about £120 (ex Vat) for simple Self-Assessments, these individuals, if they fall under ITSA shall probably be charged at least triple the amount compared to a TA doing all the work under self assessment or need to do considerably more work themselves.

MTDfVat took several years to implement

(April 2022, all businesses, including those registered for MTDfVat but under

the VAT threshold, must use MTDfV), and MTDfITSA is way more complicated than

MTDfVat.

MTD for

Corporation Tax (MTDfCT) is scheduled to start April 2026. A pilot

is scheduled to begin in April 2024 (unlikely). Update earmarked for 2026, likely to be later.

MTD for ITSA (referred to as ITSA or MTDfITSA)

- Who is in - Individuals

and Partnerships. Require either trading income from self-employed businesses and/or property businesses (if you have either of

these business types), if their combined revenue/income total is over

£10K. (To determine, need to look two years' back at the

individual's self-assessment income). If not trading in the two

years previous means you are outside MTDfITSA. I.e. new self-employed

businesses would get two years grace before they need to file using

MTDfITSA. Unlikely to be enforced by penalties. The mandatory

start for quarters is 6 April 2024. Must have combined property and self-employed

(unincorporated) business revenue over £10k combined.

- Partnerships are in if all

partners are individuals (starts 6 April 2025). I think there is a disconnect between the draft regulation and what HMRC are providing. Partnerships declare income using SA800 for a partnership. Then each individual partner has to do a self-assessment. There is no way partnership income counts as self-employed income so partnerships are not a criteria for MTDfITSA. Need to confirm what the "General partnerships with income over £10K that have individual partners need to join MTDfITSA" refers to, I suspect it is incorrect.

- Trusts/estates, LLP and Ltd

are out at the start.

- 1.3 million landlords in the

UK as of 2021.

- Roughly 40% of Self

Assessments are filed by individuals for themselves. This is going

to be tricky with MTDfIT. If these individuals wish to file, they

will need to do the quarters, have digital records, and use free software

(HMRC are not providing MTDfIT free software). They will also need

to do MTDfIT EPOS and crystallisation.

- Individuals doing Self

Assessment can have ten or many self-employment businesses, 0 to 3 (4 -

Foreign property is not clear) property businesses under MTDfITSA (Ord UK

property, FHL UK, FHL EEA, Foreign property).

- One can defer MTDfIT by

changing year ends. Individuals/practices also can apply for

exclusion based on age, religion...

- The HMRC ITSA service is only able to accept end clients who

have accounting period aligned to the tax year (I believe this means 31 March or 5 April). Basis period

reform is coming and will sort out this issue.

- Digital links/keeping digital

records. Can't re-key/copy and paste. There is no

requirement to use bank feeds/PDS2 data. Some booking software firms

are likely to file quarterly MTDfIT returns for each

self-employed (and property) business. Spreadsheets are an acceptable

form of record keeping. Excel and bridging software is sufficient

for the source for filing. If recording sales can use daily sales

totals for the digital source but ideally link to the raw input

system.

- PDS2/bank feed - unlikely to

work, useful for bringing in data. The issue is that the bank

account would need to represent a single business; also, the mapping would

be very rough into the MTDfIT categories. Things like purchases from

Tesco can't understand where to place the transaction. As MTDfITSA

quarterly is a rough estimate. It is possible as an option.

- Quarterly MTDfITSA is done per

business and is due 1 month after quarter period ends. Penalty

points for late filing, missing 4 quarters in 24 months, is £200

penalty. Record of last 24 months retained. Property

business quarters and year end run in the same cycles as personal

tax namely start 6 April and end the following year 5 April. As

MTDfIT starts on 6 April 2024 (was 6 April 2023 but postponed again notice provide on 22 Sept 2021), the 4 quarterly submission for the

2024-2025 tax year and filling due dates are:

|

Qrt start date

|

Qtr end date

|

Qtr submission due date

|

|

6 Apr 2024

|

5 July 2024

|

5 Aug 2024

|

|

6 July 2024

|

5 Oct 2024

|

5 Nov 2024

|

|

6 Oct 2024

|

5 Jan 2025

|

5 Feb 2025

|

|

6 Jan 2025

|

5 Apr 2025

|

5 May 2025

|

- Self Employed businesses

with a year-end of 5 April or 31 Mar, are treaded as using the same period

dates as property businesses'. The majority of Self-employed

businesses are already aligned with personal tax year ends and are "in". If you tax year is outside of this i.e. 31 Dec each year you can't use MTDfITSA.

- Each property business for

the individual needs to submit an End of Period Statement (EOPS)

each year and also a declaration for each business attached to an individual.

- Lastly, the Final "Crystallisation" (basically the final Self-assessment)

needs to be submitted covering the self-employed business, the property

businesses and the personal tax affairs of the individual.

- Late payment has

interest penalties, basically no penalty for 15 days late,

then 2% for 16-31 days and then 4% is paid after this. 4% is on the outstanding

balance from day past due. Payment is due following year 31 Jan.

- MTDfITSA adjustments can be

done after the quarter and resubmit or at the EOPS.

- Quarterly submissions are

estimates and can be adjusted per quarter or finalised at year-end for

each business. Revenue could ask for proof of digital linking, so

you can't just throw in a rough estimate.

- After every quarterly obligation is submitted, the response gets a CalculationID, that can be used to view the end clients "year to date tax estimate" for the business.

There are basically Two possible flows for completing ITSA Tax returns:

- Full Process/Accountant/Practice/TA has booking data and does the quarters for each trade/business, the practice then does the end of year pieces also, the issue is it will be expensive.

- Client Individual Driven Process is where the end user shall submit their ITSA quarterly returns, and then use a practice to submit the business/trades end of years and then the individuals end of year/Crystallization.

High-Level Process for TA (full process):

- Clients sign up to MTDfITSA

on HMRC using their Government gateway credentials, assuming they meet the

criteria (Agent if authorised to act on the clients behalf can also sign

the client up to MTDfITSA).

- Clients must maintain

digital records/digital linking, and it must be digitally linkable (spreadsheets are

acceptable, min req allows for daily totals in a spreadsheet). Need

to record the transaction date, category and amount.

- Perform quarterly

submissions per registered unincorporated business. It can be

submitted up to 1 month after the period ends.

- EOPS submission per

business. Due 31 Jan following year. HMRC will return the tax

calc for the unincorporated business. Also, a declaration for each business must be completed by the TA or individual.

- Final Crystalisation & Declaration (HMRC

does the calculation for the individual) are due 31 Jan following year.

- The payment date remains the

same for Tax liability due 31 Jan following year.

Note: All opinions are my own,

and I am not a personal tax expert.

Numbers:

- 32 Million Income tax payers, 4.1 million people are higher rate tax payers.

- 450k people on additional rate (45%).

- Median income per UK individual is £25k (males £27,400 females £22,200)

- +-35k Tax & Accounting Practices in the UK (rough estimate).

- 12 million people do self-assessments in the UK.

- MTD ITSA will impact around 4.3-4.7m people (Self employment & landlords).

- MTDfITSA affects 1.3m individual landlord.

- HMRC recon they will gather an extra £9 billion per year.

- HMRC estimate 1 million MTDfITSA customers will quality for the free software from vendors (less than £85k turnover and using cash basis accounting).

- of the 12.2 million SA's due for the year ending 2020/2021, 10.2 million were filed on time by 31 Jan 2022. It gets pretty crazy in filing day see HMRC's info.

- HMRC recon that +-8 million of the 12.2 million 2020/21 self assessment (SA) tax returns have been filed as of 24 January 2022 (1 week to 31 Jan deadline, with Feb no penalty extension in 2020/21 year). Interestingly the year before 9 million we filed at the same point the year before.

- The pilot ITSA HMRC sign up is extremely low. With HMRC estimating 4.3 million ITSA user sign-ups for the year starting 6 April 2024.

My Thoughts 10 Sept 2021 on ITSA:

HMRC have a lot of open questions both on the mechanics of ITSA and the API for MTDfITSA. The regulation should be finalised +-end of Sept/Oct. There are very few people that are eligible for the Pilot 6 April 2022 and very few accountants wanting to put their client on MTD. My personal opinion is that HMRC will end up delaying the start for ITSA as they did for MTDfVat until is if more flushed out. The API sandbox is not fit for pre-production however, all the vendors are doing best endeavors. So not impossible to keep the existing timelines but i do feel there will be huge changes to ITSA coming along shortly from Revenue.

Self Assessment filling options:

- Most people use the current XML online filing done 31 Jan after the personal tax year.

- Some people still use paper based self-assessment due Oct after tax year,

- MTD for ITSA will be due 1 month after each businesses quarter, EOPS and finalization/crystallization process due 31 Jan the year after the personal tax year.